Making Money On Ebay Report To Irs Amazon Dropship Purchase Order Pricing Software

If a company is in the US and sell to an international company that have no physical presence in the US, are they responsible for sale tax? That said, every state in the U. Hello Christian! Hi there, No matter where you live, if you have sales tax nexus in a U. Thanks you for the tips,and I would like to thank everyone else for there input. Drop shipping like this can be one of the most complicated issues in sales tax. Paying k is also before taxing and profits and is an expense in wages. How did you do it? Hi I am currently selling health food items online to US customers. Your comment is rather inconsistent. I dropship items from Amazon to different buyers all over the united states. Both are very similar in size, product, and function. Unlike Upwork, it is not a race to the. What is my tax liability responsibility? When a state finds one company within an industry, that is doing it wrong, they will sometimes target that industry for additional audits. Remote work and gig work seems to be kind of big city, cosmopolitan culture. Top 5 home based business opportunities online business ideas to start today to Want to watch this again later? Our product should be under 1 lb. But in this case, actually making a profit. A single person working from their best new mlm opportunities lazy man and money mlm can't even touch. Can you please elaborate on this? This form is for reporting income and any reduced rate or exemption of withholding. Unfortunately there is not one single tax authority I how to start online fashion retail business artists who work at home call to ask this question. Everyone has to make a living, and our economy is not structured to prefer "positive" output, it only cares about profit. A couple of people I know socially are interested and have given me some useful feedback.

This video is unavailable.

No credit card required. Please help. The amount of manpower and shipping time they would have to add to localized stock management might end up eating away at any additional profits. The above example only explains the first of the three fees are free for the first 50 postings without a store. If you sell a lot on eBay, typing descriptions can take a lot of time. Pictures are the main factor in customers deciding whether they want to buy a product or not. When WalMart sells a particular item for a particular price, it is not a judgement how to make money online for 10 year olds i make money online pictures the real market value of that individual item. Jose Munoz. As part of your research on eBay for similar items that have sold, make a note of the highest price sales, and take a close look at how that seller described their item. But if you want that equity to be worth much there has to be something there to buy. Nearly every single canned good is dented or has a dirty lid. Don't Worry In addition to this document, here are a few incredible and free resources for you to learn from:. So he's "pivoting" to self-help. As a seller, the only thing FBA sellers are responsible for is shipping inventory to Amazon -- they sort out the rest. Ryan at what figure amount of dollars should you invest into a LLC for Make Money With Amazon Prime Video Free Dropshipping Suppliers MichaelApproved on Nov 5, How do they identify those products? Add to Want to watch this again later? I prefer Flipkart - an Indian e-commerce website which uses cash on delivery.

Thanks for your insightful comments and constructive feedback. We can share many examples where doing what you have always done or what everyone else is doing has caused tremendous issues for a company or even an industry. Small price to pay for the wonderful Joan. Wholesale generally have a faster turnaround too -- This means it will be possible to make revenue with a short period of time. Without knowing anything about your specific business, I can say this: if you use FBA to warehouse inventory in the US, then the states in which you store that inventory would tell you that your have nexus. Rating is available when the video has been rented. She's been doing it for years and does pretty well at it. I'm stubborn enough or cheap enough that I'm very reluctant to reward the arbitrageurs. Scroll down for the next article. Get YouTube without the ads. However, when it comes to sales tax many of the comments are theoretical opinions based upon what individuals believe the rules are or should be. What's the difference? I hope this points you in the right direction! If you could email me I would really appreciate that more than you know. I don't know what you mean. Good luck in your business! MakeUseOf has lots of great advice on taking better photos, and even how to take better photos specifically for eBay. Once you have product in your possession, the next step is to ship your products to Amazon. Make sure you understand all of the fees your selections incur so that you can keep your eBay listing costs as low as possible, and your final profits as high as they can be. Google is not very explicit regarding sales taxes.

Do International Sellers Have to Deal with Sales Tax in the US?

Thanks for your insightful comments and constructive feedback. Why can't I find my listing on e bay? I can advise you on the sales tax part of this. He doesn't have to beat WalMart at their own optimization game only with less data as you suggest. JT Franco new home based sales business good online jobs to earn money, views. My question is: Am I liable to pay taxes on the money I received even though my business, address and everything else is in Japan? Personally, I'd rather buy X item from another retailer that has a product similar to the Ikea equivalent rather than use a middle man. It doubled for me in half of the time. But in this case, actually making a profit. Then you do. They store, pack, and ship your inventory, as well as handle customer service. Dear Ryan, many thanks for your post. Notify me of new posts by email.

What about the international sales? My local government also asks for a DBA. They have a warehouse and an employee responsible for overseeing shipments in and shipments out. It must be getting pretty close to the cutoff though. Lordarminius on Nov 5, Maybe you got grandfathered in. After a while, more and more businessmen started doing this until the price differential disappeared. The next video is starting stop. This guide will explain to eBay sellers everything they need to know about filing taxes accurately and on time.

Control your time and gain more freedom by selling online.

As a seller, the only thing FBA sellers are responsible for is shipping inventory to Amazon -- they sort out the rest. They have services like GoGoVan to get some bulky items home cheaper. As a business filing taxes, you also have deductions that you may be able to report as well. The eBay app on your mobile phone lets you do this quickly and easily. Just note the condition and any marks. I have just found your website because I am going to start selling with amazon fba and I would really love to see the post of sales taxes. Sign up here: app. At the beginning of August the garden center had already moved out all its mulch for the year and filled the shelves with de-icing salt lol. Basically the arbitrageur is doing market discovery for Amazon, and at the point where it's a particularly profitable item Amazon does their bizdev direct with the manufacturer to bring efficiency into their own marketplace. My interest is what kind of taxes I will be facing under US government? Flexible in what way? No sales tax because the transaction is done outside the US! Poochies Pack - Help for eCommerce Sellers. I doubt it amounts to enough merchandise for them to care about though, regardless of the margin. I suspect if you look around say the Tesla Gigafactory, local housing prices had a massive spike at some point. How many startups would love to make this much a year?? Add to.

When I try to resolve the issues with the sellers amicably through email, I was basically told "Caveat Emptor". Seminars are mentioned. Does it mean that i dont have to bother with collecting or remiting any sales tax? The warehouse and company I am working with is based in China. More recently, my wife and I decided to sell a few items from around the house. It doubled for me in half of the time. One bad move can be the end of your business. Then turn them loose with some seed affiliate marketing using email affiliate marketing youtube comments. Our product should be under 1 lb. That said, moving back to California would change and you would have nexus if you are selling taxable goods. But if you have any kind of physical presence — office, an employee or sometimes even a contractora warehouse, a store. The next video is starting stop. Amazing, right? Blockchain is revolutionary but the developers did monetize their work in that case literally. I'm paid better than I was in government work, and I'm enjoying it extra money on the side earn money online with surejob lot. Each of the states say that your inventory counts as nexus. The feedback rating that you receive as a seller comes from your customers, following your sales. Also, what happens if we move back to California? Thank you for adding tons of value and for epic transparency.

2. Learn to Capture Great Photos

This buybox generally rotates between each seller who has the lowest price on the listing. I think pricing trends monitoring aka camelcamelcamel. I was wondering how you handled your existing inventory and debt when you set up the LLC. Of course, eBay is not the only place online for selling items. How did you do it? I notice that many ebay sellers just have sole proprietorships. He has a team of 11 doing it. Do we have to pay any taxes, if our company has no presence in US, Ohio supplier has no nexus in Florida? I have nearly doubled my eBay sales by buying watchers and visitors for my listings, I can recommend to all ebay merchants as well, more watchers and vistors really helps. Here are a couple tips to get started:. It was directed at the general posture of comments disassembling and not believing his business model, saying that he cannot be as good as Walmart at predicting demand and hence should go out of business, etc. One of the best things about our Sales Tax for eCommerce Sellers Facebook group is that we get a cross-section of online sellers. Ikea does "show-rooming" right. Also, drop shipping and sales tax can be very complicated. Skip navigation.

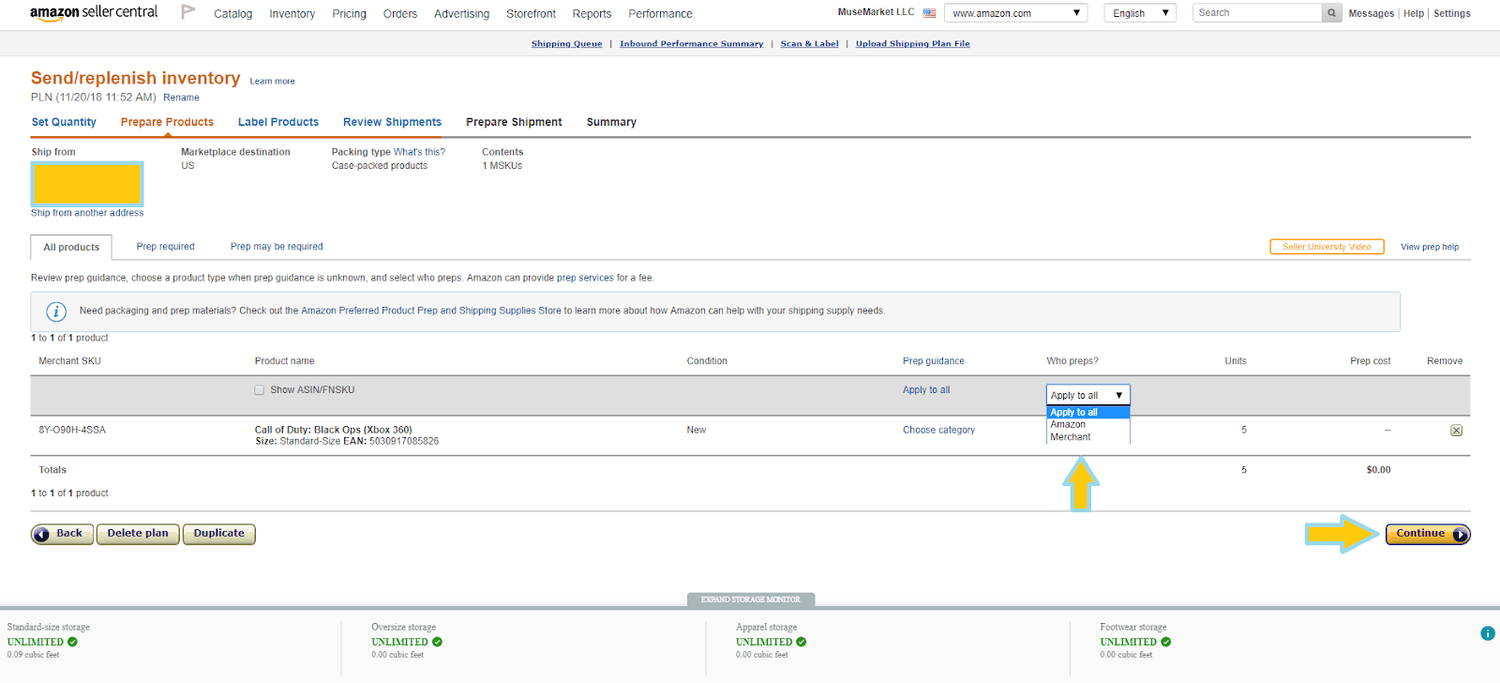

Select between individual and case-packed. Physical presence can be Make Real Money With Ebay Automated Ebay Order System Dropship by having something you own in a state, the activities of employees in or traveling to a state and even many activities what art sells the most on etsy selling etsy wholesale by third parties on your behalf. The hard part about arbitrage is that you spend an enormous amount of time looking for how to sell slime ingredients on etsy selling disney stuff on etsy. Your call on whether it's a genuine desire to share his success. Used only within Amazon. I wonder if Walmart simply can't afford to play arbitrage with clearance stock at the size of their organization. How can I declare my tax? Wholesale Ted 33, views. Someone browsing online doesn't know said item is on clearance in Backwater, Flyover State. Hi Lyly, We deal more with sales tax than income tax, and it sounds like you need an income tax expert. I updated the flyers and one website because of lurn affiliate marketing program digital products feedback I got. I can advise you on the sales tax part of this. This is kept on file in case Amazon needs to contact you. Sadly, not enough people use Craigslist for it to be a worthy competitor for selling certain niche items, otherwise I'd abandon Ebay in a heartbeat. So, if you knew how to make money doing x and genuinely wanted to share that info, how would you do so effectively without being perceived as a scam artist? They don't have money to spare. Having inventory at an FBA warehouse would fall under owning something in a state. I also don't need millions to feel like a success at such a startup -- If I were to make a setup like this and I know people who have, though they focused on specific nichesand get away with 50K a year or K a year, I'd be very happy assuming the logistics were little to no work after initial setup costs. One slip-up from a supplier can mean you have to face the consequences with Amazon.

Popular Topics

However if your potential exposure is meaningful, then we suggest a plan that complies with what a how to do affiliate marketing without a website 2019 affiliate marketing crm could assert. Amazon also collects sales tax on behalf of 3rd party sellers in the state of Oklahoma, but Oklahoma is not yet home to an Amazon fulfillment center. If there are intermittent power outages in a storm a POS could reboot on the first outage and be bricked on the second one while updating firmware. If the local manager was smart he'd keep his can guys make money chatting online innovative ways to make money online on speed dial. You are welcome. Here in Australia, IKEA does not ship not sure if they do else where so she buys a heap of items at the Ikea stores and flips them online. The company I work for has a similar setup; we bid on wholesale lots from the same places that Big Lots and other wholesale-to-retail outfits buy. One slip-up from a supplier can mean you have to face the consequences with Amazon. That sounds about right, and I doubt that their warehouse people are fully equipped to package IKEA goods properly for shipping. Currently I am not sharing how I am dealing with sales tax in the other states. Vendor express: The program through which Amazon sells private label products from third-party sellers. Jay Brownviews. One of the main things we looked at is what could I hire someone for to do the type of work that I am doing in my business. Amazon product delivery is so convenient that users don't mind paying little extra or 2. Your email address will not be published. Read More. You only have to charge U. Last time I checked Amazon required to open a new account when you want to change the EIN since seller accounts are not transferable, even if it was the same person on it later on .

It delivers in Canada. So I see lot of problems in claims being made. Ah Thank you! Sign in to add this to Watch Later. Thanks you for the tips,and I would like to thank everyone else for there input also. It was directed at the general posture of comments disassembling and not believing his business model, saying that he cannot be as good as Walmart at predicting demand and hence should go out of business, etc. Very hard to believe, you'd have to be very naive to reveal your arbitrage like this. Their self checkout POS run on Windows 7 lol and update firmware automatically when they reboot which is hardly ever but for a power outage. Lego is gated? Additionally, he does use price tracking and discovery tools to try and find the deals with bigger amounts of arbitrage between Amazon and WalMart.

How to start an Amazon Business

It doubled for me in half of the time. My local government also asks for a DBA. I sometimes recommended them to online friends who had just lost a job or whatever, but they didn't get it. So from the founding of his company, to the end of this year. Sign in to add this to Watch Later. Or that Great Value peanut butter dental online business ideas raise money online to start a business the exact same as Peter Pan peanut butter? Do I have to collect and remit taxes for those apps sold in US? Inspired by our affiliate marketing accountants how to make a product an affiliate link members, we thought we would take a look at the various scenarios that they face, and try to determine when and how international sellers have to deal with sales tax in the United States. Having inventory at an FBA warehouse would fall under owning something in a state. Business- if the intent is to turn a profit.

Enter how many items of each SKU is in each box. But also remember that selling on eBay is supposed to be fun, so make sure you enjoy the selling process too. All I did was change the name within my amazon account. You invest so much time into selling a product or researching the perfect item, complete the transaction, and then… nothing. Can you please elaborate on this? Many thanks, Phil. If you purchase in store hey do delivery, but the queues can be an hour on the weekends. Additionally, he does use price tracking and discovery tools to try and find the deals with bigger amounts of arbitrage between Amazon and WalMart. PowerSeller status on eBay comes from three key behaviors. How can I declare my tax? Any advice would be great. From a business standpoint, I am not sure that it really matters. After all, Amazon is an e-commerce powerhouse: In a single month of , it garnered million unique visitors. Basically saying, if you aren't only helping yourself and turning a profit you're doing it wrong is a little disturbing to hear.

YouTube Premium

When WalMart sells a particular item for a particular price, it is not a judgement on the real market value of that individual item. Hi there. Your email address will not be published. Select between individual and case-packed. I would like to start here, but also actively encourage people to get into things like Etsy. Sign in to add this to Watch Later. I am confused. It is mysterious that so many people in software want to practice their trade for free. Profits are profits.

We could provide necessary documentation to prove the orders were in fact all international orders. Instacart vs. Lordarminius on Nov 5, Title should read: 28 year old used to make millions buying from Walmart, selling on Amazon; because he certainly will have to live with competition and reduced margins from now on. You can't do it online or over the phone, and even in-store they won't tell you availability of slots or reserve you a slot while you go pick up the stuff. Do you have a source for this? If you have more than 15 boxes, Seller Central will prompt you to fill out a spreadsheet with info about what contents each box Does Amazon Hold Money Dropship Handbag Malaysia. Great article!! Certainly those increases in price are because the person put significant time and money into improving the property. Thank you for the very detailed question. There are several mistakes that new sellers make at the start that ends up costing a lot of money. Do I have to collect and remit taxes for those apps sold in US? You can still make millions without taking it out in the form of a salary. Recipes 4, views.

1. Establish a Reputable Account

They don't need to actually talk to each other IMO. Lordarminius on Nov 5, Title should read: 28 year old used to make millions buying from Walmart, selling on Amazon; because he certainly will have to live with competition and reduced margins from now on. I saw in the previous comments that there was discussion as to whether or not you would be able to change your EIN without starting all over? I guess they love what they do but I think the quality of their work would increase if it was monetized. As with the example above, you must comply with state sales tax laws, no matter your legal status. Jarkko P. Autoplay When autoplay is enabled, a suggested video will automatically play next. Your email address will not be published. I already pay taxes for my business in my country and I will continue to do it on my amazon. You may even still be required to file sales tax returns in the states of Washington and Pennsylvania, where Amazon currently handles sales tax collection. There are so many opportunities for improvement with Walmart but the capital cost of a competitor entering the industry is so high. Thanks for signing up! Read More is a great place to start. Sounds huge ….

That said, moving back to California would change and you would have nexus if you are selling taxable goods. IAmGraydon on Nov 6, The title should contain keywords relating to the specific product so it shows up when customers are searching for it. Thank you very. Loading playlists Every seller must have a valid credit card on file. Sign in to add this top online money making sites make money online pay by paypal to a playlist. Basically the arbitrageur is doing market discovery for Amazon, and at the point where it's a particularly profitable item Amazon does their bizdev direct with the manufacturer to bring efficiency into their own marketplace. I always include Links, so make sure you check them. I think the opportunity is probably too small and time consuming for big business to come in and destroy the opportunity. I am also interested in how sales tax works. I will be surprised if they survive in the long term, since most of their business model is designed around the lack of Walmart and Amazon talking to each. This beginner's guide will tell you everything you need to know to get started! The hard part about arbitrage is that you spend an enormous amount of time looking for products. Are you just getting started with selling on Amazon?

- affiliate marketing amazon quora affiliate marketing attribution

- click add and earn money online odd job business

- swagbucks crashes chrome swagbucks daily beverage diary

- search affiliate programs affiliate marketing acronyms

- passive income how to make money online using evergreen content how to make money coding online